LOGISTICS: Asia-US container rates slide; USACE plans to open Baltimore port by 1 May

Rates for shipping containers from east Asia and China to the US continue to slide, liquid chem tanker rates surged from the US Gulf to Europe and Asia. and the US Army Corps of Engineers (USACE) plans to open the Port of Baltimore by the end of the month after the Francis Scott Key bridge collapsed on 26 March, highlighting this week’s logistics roundup.

PORT OF BALTIMORE

“In collaboration with industry partners, USACE expects to open a limited access channel 280 feet wide and 35 feet deep,” USACE said on Thursday. “This channel would support one-way traffic in and out of the Port of Baltimore for barge container service and some roll on/roll off vessels that move automobiles and farm equipment to and from the port.”

USACE engineers are aiming to reopen the permanent, 700-foot-wide by 50-foot-deep federal navigation channel by the end of May, restoring port access to normal capacity.

While not a big hub for chemical imports/exports, the closure of the Port of Baltimore because of the bridge collapse will have some ripple effects for logistics in the region.

CONTAINER RATES CONTINUE TO SLIDE

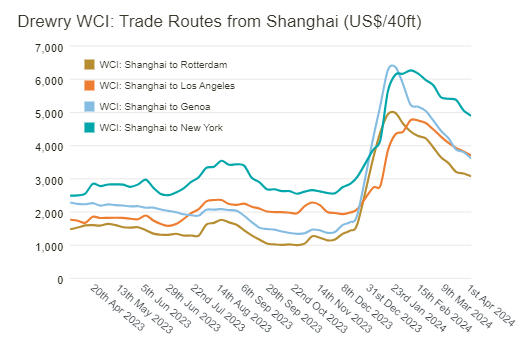

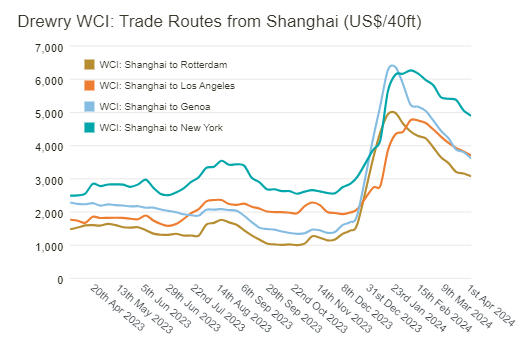

Rates for shipping containers from Asia to the US continue to fall, in line with the decline in average global rates.

The following charts from supply chain advisors Drewry show the decrease in average global rates and from Shanghai to the US and Europe.

Judah Levine, head of research at online freight shipping marketplace and platform provider Freightos, said rates could be nearing “a diversion-adjusted floor”.

LIQUID TANKER RATES SURGE

US chemical tanker freight rates rose this week on the major trade lanes – from the US Gulf (USG) to ARA and to Asia.

For larger parcels, spot rates ticked higher to both regions as several outside vessels have expressed interest to come on berth for this route in April and for May.

This in turn, has curbed the rates from rising any further and somewhat modest.

Premiums for discharge in China have also closed the gap on main port rates, as China’s activity buying glycol has picked up.

From the USG to Rotterdam also has strengthened following the recent Easter holiday, as strong interest in EDC has been seen in the market.

There has been activity on the spot market, but owners are still working with COA customers to finalize their needs before committing to others.