Container rates rise on peak season surcharges, but rate of growth slowing

Rates for shipping containers continue to surge as carriers are implementing peak season surcharges while capacity remains tight from Red Sea diversions, but some shipping analysts think there are signs that the dramatic rate of growth may be slowing.

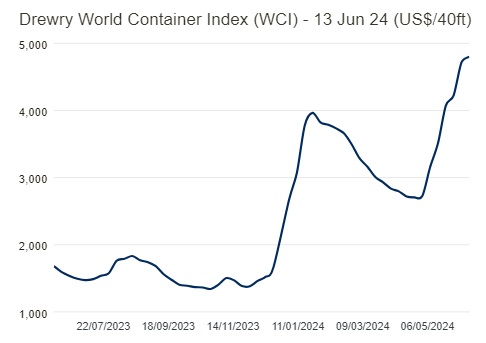

Shipping container rates continued to rise this week, but the rate of increase slowed, according to data from supply chain advisors Drewry and as shown in the following chart.

Ocean freight rates analytics firm Xeneta said its data indicates spot rates on major trades out of Asia will increase again on 15 June, but to a less dramatic extent than witnessed in May and early June.

Average spot rates from Asia to US West Coast are set to increase by 4.8% on 15 June to stand at $6,178/FEU (40-foot equivalent unit). However, on 1 June, rates on this trade increased by 20%.

From Asia into the US East Coast, rates are set to increase by 3.9% on 15 June to stand at $7,114/FEU. Again, this is a far less dramatic jump than when rates increased by 15% on 1 June.

Rates from north China to the US Gulf are at the highest this year but leveled off this week, as shown in the following chart.

“Any sign of a slowing in the growth of spot rates will be welcomed by shippers, but this is an extremely challenging situation, and it is likely to remain so,” Xeneta chief analyst Peter Sand said. “The market is still rising, and some shippers are still facing the prospect of not being able to ship containers on existing long-term contracts and having their cargo rolled.”

Container ships and costs for shipping containers are relevant to the chemical industry because while most chemicals are liquids and are shipped in tankers, container ships transport polymers, such as polyethylene (PE) and polypropylene (PP), are shipped in pellets.